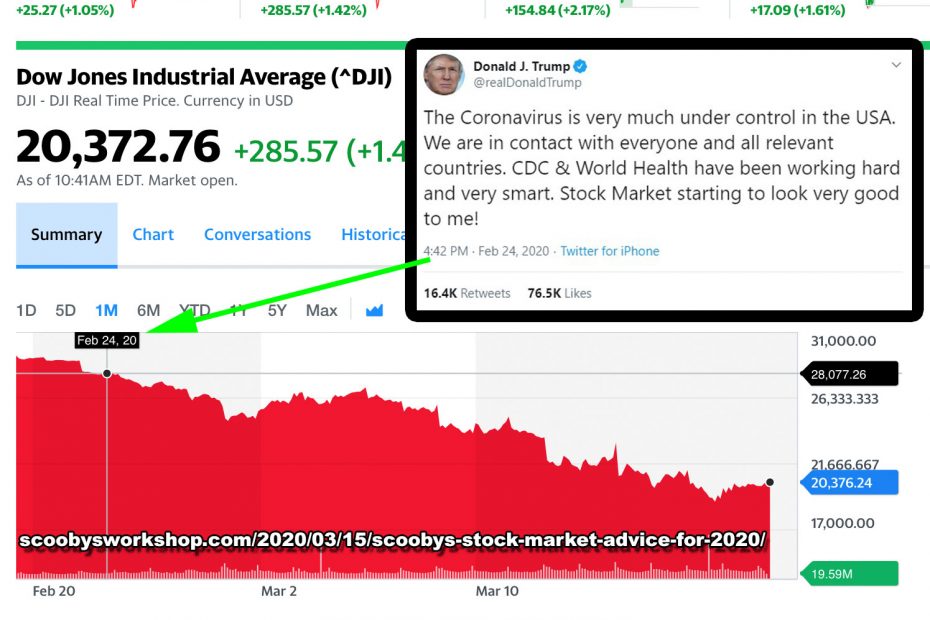

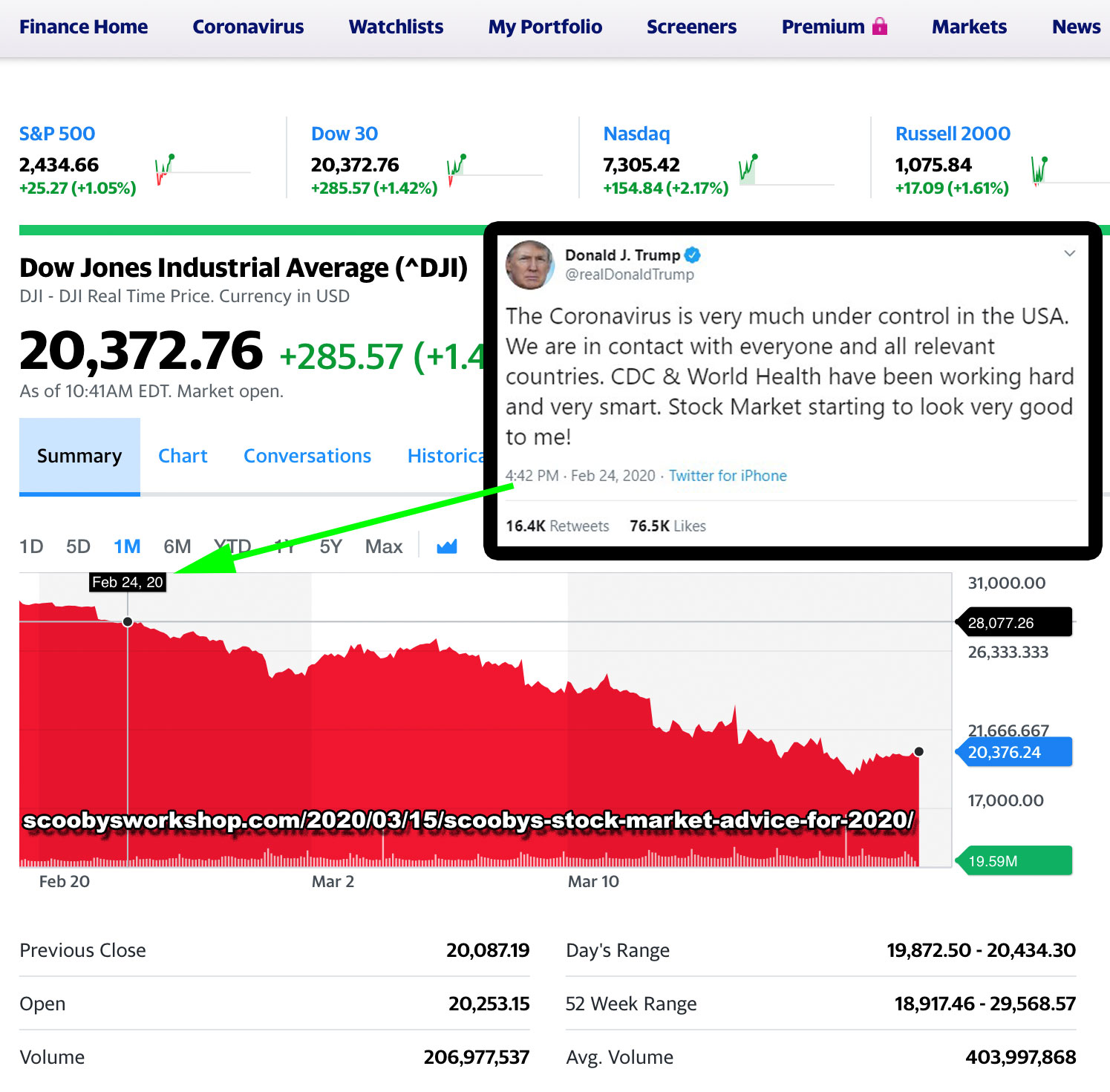

This is NOT the time to panic sell, its time to buy. Not just Dollar Cost Averaging but accelerated DCA. Dollar Cost Averaging is the only guaranteed method to beat the market in the long term but this year with a global pandemic warrants a little different treatment. Rule #1 is do not listen to President Trump. There are two strategies I will be using and I can recommend them to you as they are virtually fool proof:

- Accelerated DCA

- Surfing the stock market trough

Remember that any money you invest now into the stock market, you need to be prepared to wait 10 years for it to pay off as this recovery could be very long in the coming. DCA is not a get rich quick strategy, its a long term investment strategy – multiple decades long. Its a way of building wealth so you can retire without having to live in a tent under an overpass, not a way to buy a Ferrari next year.

Accelerated Dollar Cost Averaging

OK, market is way down. I still stand by the prediction I made at the end of February for a Dow below 15,000 (down 50%) in 2020. We have barely started feeling the effects of the coronavirus here in America and we have a lot of bad news to weather before things are going to start looking better. So you have been making your monthly purchases of a fixed dollar amount of stock and now that prices are so cheap, its time to up your purchases to lower your overall average purchase price! First of all, its always important to have cash reserves for a few months so do NOT put these reserves into the stock market no matter how tempting. Decide how much cash you have that can be put into the market and divide that by 5, 20% for each of 5 purchases. Rather than setting up a monthly fixed amount on a certain day, we are going to set up limit orders. For example, the DJIA is now sitting at 20% down from the peak. Each time it drops 5% more, I will put in one of the 20% lumps. So, for example this is how you would set your limit orders for the amount you want to invest:

When DJIA hits:

- -25% (22010) – put first 20% into market

- -30% (20542) – put 20% more into market

- -35% (19075) – put 20% more into market

- -40% (17608) – put 20% more into market

- -45% (16140) – put last 20% into market

Here is why you cant lose. Worst case with this strategy is that I am TOTALLY wrong about my dow 15000 prediction and the market is poised for an explosive climb and you will miss out on gainz BUT you have cash reserves still as cash which is important in uncertain times like this. If my DJIA 15000 prediction is accurate then you will buying some of the shares before hitting the bottom BUT because of DCA you have done pretty darn well. If the bottom of the market is somewhere between -25% and -45% then because of these stepped limit purchases you have optimized your investing as much as possible without a time machine.

What stocks to buy

OK, so exactly what do you buy when you put your 20% into the market? Please do not pick individual stocks because you WILL lose your shirt! As I say on my Dollar Cost Averaging page, please choose an index fund. Dont try and time the market, dont try to pick winning stocks, just choose a good index fund. What is a “good” index fund? #1 criteria is low fees. Although the difference between a 0.03% expense ratio a 0.11% expense ratio might seem laughably small, over the years they eat up your gainz. My favorites are all EFTs:

- VOO a Vanguard ETF which is based on the S&P 500 – expense ratio of 0.03%

- VTI is Vanguard ETF is a “total market” fund – expense ratio of 0.03%

Note that many funds have expense ratios 2-7x more than this.

Surfing the stock market trough

In crisis times you can count on one thing: people over-reacting. Because I saw this coming and sold at the top of the market on Feb 20 I have a lot of room to play. I am also 99% certain that I am right about my prediction of a 15,000 DJIA. Given these two facts and the above accelerated DCA strategy I have been doing something I call “surfing the stock market trough”. On March 11, President Trump addresses the nation and for the first time acknowledges the seriousness of the epidemic. The next day, all the people who President Trump had convinced that coronavirus was no worse than the flu, went into total panic which sent the DJIA down to 21,500. I figured that although the dow still has a long way to fall, people were over-reacting to this particular news so I put 20% into the market since it was close to time for another accelerated DCA purchase. I also counted on a rebound from the news the next day so I set a limit order at a price 5% higher – surfing the trough. If the stock market continues to fall, no biggie, I was due for an accelerated DCA purchase anyway. If it rebounds then I make my 5% and then when my next price trigger hits I put in 40% instead of 20%. Remember though, two important things about surfing the trough:

- Do not purchase stock unless you will be happy keeping the stock for a decade

- Remember that your goal is accelerate DCA. Do not ruin your DCA by selling off tiny gains quickly and ending up with nothing. When you surf, remember that on your next purchase you have to “catch up” on your DCA purchases such that you keep to the above schedule. For example, when the market is at -45% you should have 80% of your funds in the market.