Go ahead and laugh at my expense, I hope to come back to this video and laugh at myself as well. Remember though that I was the one who saw this coming and sold 100% of my stock on February 20 at the peak of the market before the corona-crash. I had plans to take a 2 week bike trip in Thailand on March 6th and was finding that my inter-asia flights were getting cancelled as quickly as I could make them. The day I found that there was not a single flight from Phuket to Singapore was the day I said “Wow, people do not realize how much airlines are being smashed by this and how it will ripple thru the economy”. That day, Feb 20, I sold all my stock. People here in America are still in denial about what the coronavirus will do to our supply chain and the productivity of our corporations.

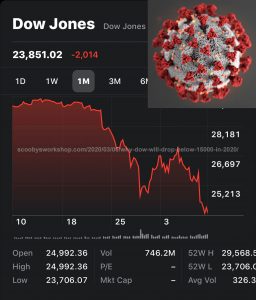

Six reasons the Dow Jones Industrial Average will drop below 15,000 in 2020.

- The fact that a large percentage of the population thinks “flu is worse than coronavirus” and that “we have absolutely nothing worry about” because this is “just the media trying to scare people” is setting us up for a further collapse of the stock market. These people are still confident in the stock market. I predict that as time goes by, it will become apparent to even the corona-deniers that it is not fake news at which time they will pull all their retirement money out of the stock market. In an ironic twist, its precisely these corona-deniers who will turn what could have been a manageable crisis into a national emergency with waiting lines for every hospital bed in America. When these corona-deniers get the virus, rather than quarantine themselves at home they will laugh it off as “just the flu” and go about their normal lives which will expose dozens of other people. When the corona-deniers finally see that this is an actual crisis, their selloff will cause the market to drop to the DJIA 15,000 level before the crisis is over.

- Even if we don’t have lockdown of American cities that will be affected by coronavirus, the ripple effect from the transportation, airline and tourist industries all but shutting down will be far greater than people realize. No numbers have been released to my knowledge but I would not be surprised if revenue for the major airlines is down 20-80% this quarter. The problem is that the airlines still have to make loan payments on thousands of really expensive airplanes sitting around gathering dust. Costly bailouts will be required to keep the entire airline industry from failing. Our supply chain has not yet begun to feel the coronavirus effects yet and when it does, productivity numbers of US manufacturers will plummet. For example, many people do not realize that “American Made” cars are not really American. The iconic Ford Mustang has 35% foreign components. A car has literally thousands of parts and it takes a shortage of just one of them to stop the assembly line and send everyone home early. The supply pipeline is long and complex and when reigons like Wuhan go offline for a few months, it creates air bubbles in the pipeline that will work their way around the globe and eventually cause the gushing pipeline at Ford Motor Company to sputter. We have reaped the benefit of globalization and now we will learn the costs.

- Many Americans are convinced that our country will not be affected like Italy or China but I say they are wrong and this hubris is very dangerous. I say coronavirus will hit us way harder than China for several reasons. First because we are a democracy where people have the right to be anti-vaxers even if it puts the public health at risk. We simply cannot use the authoritarian approach that has worked so well in squashing the epidemic in China. Also, because most of Americas workforce cannot afford to stay home if they are sick. They don’t have paid time off and if they don’t work, they don’t get paid, and they get evicted. Most of Europe provides for full salary for up to 6 weeks in a situation like this so Italians can afford to stay home from work if they are sick, we can’t. A bunch of sick people going to work is a recipe for a bigger disaster, not a smaller one. In France actually people are allowed to stay home and get paid without fear of retaliation if they fear for their health. We have none of those protections.

- Another industry I predict will need a huge bailout is the insurance industry. Claims for this crisis are going to make hurricane Katrina look like a failed lemonade stand. Claims by individuals for cancelled travel will be bad enough but the corporate claims are what will be staggering. My point of reference here is the claim I am trying to make for my 2 week bike trek that was scheduled for Mar 6- Mar 2o in Thailand. The 800 number for making claims has a wait time of over 6 hours and the website which has been down for 4 days.

- The Trump Administration is still not taking the coronavirus seriously because it is politically inconvenient with a re-election around the corner. Even on March 6, today, the President is saying its not that bad and that the falling stock market is due to “fake news”. Its great that the American government finally passed an $8.3 Billion measure to combat coronavirus but it is way too little, way too late, and shows precisely why we are in for a long slide to DJIA 15,000. That $8.3 Billion would have been enough back in December and could have prevented the embarrassing disaster we have right now where on March 6 we still do not have enough test kits to know the extent of the disaster.

- The last reason is that the corporate stock repurchases will now end. Many CEOs salary was tied to stock performance and what better way to raise stock price than to increase demand for the stock by having the corporation buying it back. Apple for example repurchased $175 Billion of its stock in 2018/9 – that is about 17% of their stock. With earnings corona-slashed, these large companies are no longer going to be able to repurchase their own stock and this weakening demand will fuel the stock price fall.

Should I sell?

No! No! No! What action should you take based on this blog post? NONE! Why? Because attempting to time the stock market never works. People are emotional and they buy stock when the price is really high and everything looks great and sell in times like today where things look terrible and the stock market is low. Do NOT sell low! What should you do? Dollar Cost Averaging (DCA) is the only guaranteed way to make money long term in the stock market!!!! Every month, invest the same dollar amount into the stock market, that way, you buy more shares when its cheap and fewer shares when it is expensive.