I have had this car for 6 years and it still gives me #SparksOfJoy. Most people end up wasting all kinds of money on cars and I am here to show you how I got this new Porsche Boxter S with payments less than that of a Ford Fiesta which is the cheapest car in America. I got my new 2006 Boxter for $250/mo.

Leasing – how most people buy expensive cars

You can buy a car with a loan but for high end cars, the payments can easily exceed your rent or house payment. Because of this, most people lease. The payments are less, there is no maintenance cost, and you get a new car every two years! What a deal? … or not, lets take a look.

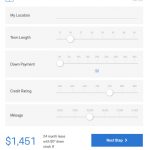

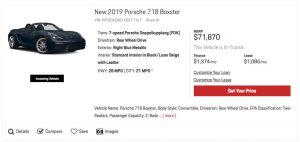

If you go to the Porsche lease calculator and check on lease prices, getting a Boxter S like mine is $71,000 without any options so lets just use that price. Go to their lease calculator and set a 2 year lease with 10,000 miles per year and you get payments of $1451/mo – holy smokes, who can afford that? Well, its a lot less expensive than the $1623/mo it would cost you to buy it outright with a 5 year car loan.

Perhaps $1451/mo with nothing down for a new Porsche sounds like a good deal to you especially when there is no maintenance and you get a new one in just two years but lets look at what is really going on here and see if you can afford it. Lets say you lease this car then do another lease after that – four years of leasing. At the end, you have nothing. As a matter of fact, not only are you without a car but you owe a lot of money too because you drove more than the 10,000 miles per year allowed by the contract. Over the four years you have made 48 payments for a total of $69,648 – basically the price of the car. Do you see where I am going here?

How to get a car bargain

The way you get a car bargain is simple!

- Save money for your new car by driving your current piece of junk or riding your bike until you have the entire purchase price saved.

- Buy the new car with cash.

- Drive it for 20+ years.

- repeat

That is how I got my new Porsche Boxter S for $250/mo. I saved money till I had enough, I bought it with cash ($61,000), and I will drive it 20-30 years. If I only drive it 20 years, that works out to be a monthly cost of $254/mo. I have had it for 6 years and its as beautiful as the day I took delivery and only has 33,000 miles. This is not a car you get tired of and every time I see it I still get #SparksOfJoy.

Car as an investment

Don’t fool yourself, a car is not an investment. Investments go up in value, not down. A new car you buy today will be worthless in 30 years. The one exception is classic cars which can be spectacular investments BUT these cars cost hundreds of thousands of dollars to buy and are so valuable that you simply cannot afford to drive them other than at car shows.

The biggest car bargain

The biggest car bargain of all is not to own one! Americans have been brainwashed into thinking we HAVE TO have a car. A car is very expensive. Its not just the lease price, its gas, its oil changes, but its INSURANCE and PARKING too. If you live in a big city, you can add monthly parking cost because you are sure as heck not going to park your new $70,000 car on the street where people bang into it all the time. Add $300/mo for parking, $150/mo for insurance, and $200/mo for gas and your $1451/mo Porsche lease is now costing you $2100/mo.

Many people who scream that they “HAVE TO HAVE A CAR” simply dont understand. They DO have a choice, its just that the choices they have made require them to have a car. They could have just as easily made decisions so that a car was un-necessary. For example, instead of living in the suburbs where you get “more for your money”, live in the city where everyone in the family can take public transit, use Uber, or use their bikes to get around. inb4 “its not safe”, thats an excuse and you know it.

I admit it freely, I do not need a car, I WANT a car. I use my bike for everything, the car is for fun. People miss the fact too that its not all or nothing. For example, I could easily argue that I NEED a F-250 pickup because I do so much construction work on my rental properties. The truth is that I can simply rent the Home Depot truck for $19 each time I need to get a load of supplies. Its not convenient but its 1000x cheaper than owning a big gasoline chugging truck that is really only needed 10 times a year.

Cars are literally a waste of money. The biggest car bargain of all is if you dont buy one. If you WANT one, thats fine, be honest with yourself that you are willing to make the financial sacrifices to have one. Pretty much the only time it makes sense to buy a car is if you need it for your work, for example, if you are an Uber driver then you need a car.

The “Golden Rule” for becoming wealthy

We can generalize the advice above as follows:

Only get loans to buy things that go UP in value.

Cars go down in value; therefore, do not borrow money to buy one. I don’t care how low the interest rate is, even 0% financing. The point is that you should not buy anything that goes down in value unless the money is already sitting in your savings account and isn’t needed for something more important. If you want to borrow money then buy a house because they go up in value.

Many people will say they have no loans without realizing that they have actually been trapped by the most evil loan of all – the credit card. If you do not pay your balance in full, on time, every month then that is a loan. Not only that, its literally a loan where you pay 10%-25% interest which makes them the most expensive, worst type of loan ever. Europeans understand this but Americans often dont because they were never taught basic personal finance. If you dont have the money, dont spend it.

The HELOC (Home Equity Line Of Credit) is a close second to credit cards for the most evil of loans. You might think that because its a loan on your house which goes up in value then its OK based on what I said above. Nice try. The issue is what you purchase with the borrowed money needs to go up in value. If you use your HELOC loan to take a big vacation and buy a Lamborghini, thats a really bad financial mistake. About the only valid use for a HELOC in my opinion is to use it to buy a rental property.

Personal Finance and how to get rich

On a related subject, please see my how to get rich series.