As I mention in the “Is Scooby Rich“, its not how much you make that is important, its how much you save. We are pressured from everywhere to spend, spend, spend. People feel pressure to keep up with their friends, their co-workers, and families. Success is that shiny car out in front of your house even if you cant afford the payments, right?

So many people fall into what I call the lethal “Its just …” trap. My cellphone is “just” $50/month. My cable TV is “just” $70 per month. My Netflix is “just” $20/mo. My car payments are “just” $350/month. My Starbucks coffee is “just” $5 a day. Add up all these little things and you will find your entire salary gone at the end of the month, no matter how much you make. Do you WANT it or do you HAVE to have it? Ask yourself this and answer seriously. Will you die, go to jail, or lose your job if you don’t spend that money? No? Then you WANT it, you don’t HAVE to have it.

But I work hard, I deserve …

Tough love time, stop the whiny crap. You don’t “deserve” anything unless you work your butt off for it, and sometimes, even then you can’t have it. Put things in perspective by talking to someone who lived thru the depression. Someday I will post my interview with Helen where she talks about the depression – people today do not realize how really easy we have it – seriously! I consider myself very fortunate to have been able to hear first hand stories from my grandparents and from our good friend Helen about their experiences in the depression. If you don’t know anyone who lived thru the depression, read some first hand accounts … then tell me what you “deserve”.

But I worked my butt off in college for 5 years, I “deserve” a new car!

Do you need a new car or do you want a car. Does your old car work? Could you take public transit to work? Could you bike to work. What about uber? Have you done a spreadsheet to compare the cost of all the options? Make sure to include insurance and maintenance into the car ownership costs and you will see that a new car is a very expensive option. A new car is most peoples first major purchase getting their first job but its exactly what will put the final nail in your financial coffin. I know its hard because everyone expect you to spend money but upon getting your first job, you need to keep living like a poor student. Resist the urges to buy all kind of stuff that you “deserve” and save that money instead. That cash in the bank will be your freedom, your ticket to transitioning to a job you LOVE.

Do you want to work the rest of your life at a job you hate? If so, keep spending your hard earned money on all these little niceties that you “have to” have. If you don’t want to spend the rest of your life at a job you hate, then STOP wasting money on things that are not essential and SAVE it. Its called “delayed gratification” and if you can master it, you will be RICH.

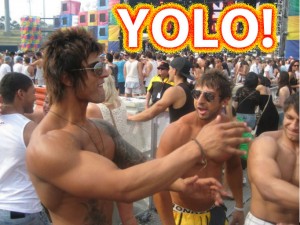

What about YOLO?

You Only Live Once (YOLO), right? Live life to its fullest. Live for today and spend like there is no tomorrow. Fly to music festivals all over the world and party, party, party. Party like there is no tomorrow. Zyzz epitomized this modern mindset and I will leave it to you to decide if that is a role model for you. Some people would rather die young, famous, and a hero to an entire generation than to live a long, happy, and “uneventful” life. Thats your choice but remember one thing, there is only one Zyzz. If you attempt to follow in his footsteps it is very unlikely that you will succeed – many have attempted and failed embarrassingly #jefplsgo. To be rich by my definition means being anti-YOLO. Being rich requires that you be willing do delay gratification, in other words, save now and spend later. If you are YOLO and spend like there is tomorrow, someday you will wake up and it IS tomorrow – then life will suck, bigtime. You may have the time of your life in your teens and early 20s but then one morning you will wake up hung over with credit card debt up to your ears and no marketable skills – congratulations, you have just entered indentured servitude (aka slavery) and your un-escapable credit card debt will be your ball and chain for the rest of your sorry, hard life as you move from one horrible minimum wage job to another until you die.

Saving money doesnt require winning the lottery or getting a raise. Saving money just requires making good financial choices – lets look at two small examples.

Your daily coffee

Lots of people get their daily coffee at Starbucks or equivalent specialty coffee places. Average amount spent, $5/day which is $150/month. Do you NEED $150 of coffee a month or do you WANT it? Addicted to caffeine? Cheaper options, do what our grandparents did – instant coffee! This $10 bottle of instant from Costco will last you a month or two and let you save $1,700 a year. Not that much you say? Well, how much did you save last year? I rest my case.

Your haircuts

Its one of the two reasons I cut my own hair, to save $5,000 dollars and to save hundreds of hours of time – both precious resources.